Reports of stimulus payment-related fraud have sharply increased following the passage of the second stimulus package. Given the drawn-out pandemic, coupled with an enormous amount of uncertainty, individuals may be susceptible to fraud.

Since January 2020, Americans have lost almost $300 million to COVID-19 and stimulus payments-related fraud, according to the Federal Trade Commission. The agency also received over 316,000 complaints with the median fraud loss at just over $300.

According to the IRS, U.S. residents should expect to receive stimulus checks delivered via three methods: a direct deposit into an account, payment cards or paper checks. Nevertheless, the American public continues to encounter instances of criminals using stimulus-themed emails and text messages to trick individuals into providing personally identifiable information and bank account details.

Advanced Fraud Solutions recommends that financial institutions remind their members or customers about the importance of remaining vigilant to fraud attempts, especially now. Here are some of the most dangerous fraud tactics and recommendations:

-

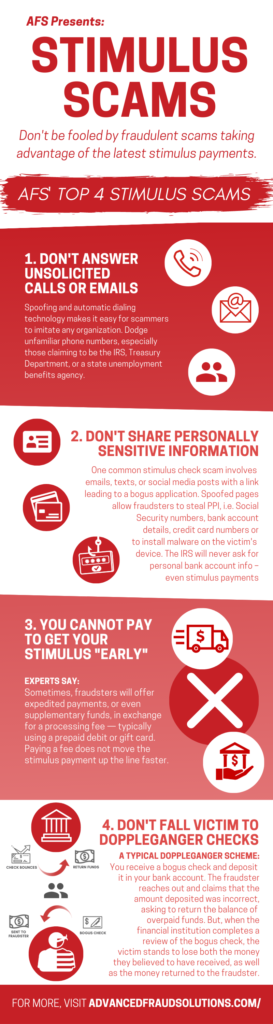

- Don’t answer unsolicited calls or emails. Spoofing and automatic dialing technology makes it easy for scammers to imitate any organization, including government agencies. Most experts recommend consumers dodge picking up any calls from unfamiliar phone numbers, especially those claiming to be from the IRS, Treasury Department, or a state unemployment benefits agency. If you think a call or email is legitimate, initiate a separate means of communication. Also: do not fall for scammers’ requests for sensitive information immediately, and never sign a check over to anyone else.

- Don’t share personally sensitive information. One common stimulus check scam involves emails, text messages, or social media posts asking individuals to click a link leading to a bogus application. This spoofed page allows fraudsters to steal personal information, such as Social Security numbers, bank account or credit card numbers, or to install malware on the victim’s device. The IRS will not call, text, email, or contact you on social media asking for personal or bank account information—even related to stimulus payments.

- There’s no way to pay to get your stimulus “early”. Another con involves fraudsters offering expedited payments, or even supplementary funds, in exchange for a processing fee — typically using a prepaid debit or gift card. Bottom line, paying a fee does not move the stimulus payment up the line faster; no one needs to pay to receive a stimulus check, period.

- Don’t fall victim to doppelganger checks. Typically, this scam starts when a recipient receives a bogus check and deposits it in their bank account. Then the fraudster will reach out and claim that the amount deposited was incorrect and asks them to return the balance of overpaid funds. But, when the financial institution completes a review of the check and determines it a fake, the victim stands to lose both the money they believed to have received, as well as the money returned to the fraudster.

- Don’t answer unsolicited calls or emails. Spoofing and automatic dialing technology makes it easy for scammers to imitate any organization, including government agencies. Most experts recommend consumers dodge picking up any calls from unfamiliar phone numbers, especially those claiming to be from the IRS, Treasury Department, or a state unemployment benefits agency. If you think a call or email is legitimate, initiate a separate means of communication. Also: do not fall for scammers’ requests for sensitive information immediately, and never sign a check over to anyone else.

- (Advanced Fraud Solutions, 2021)